The Inevitable Convergence of HFT and MFT?

How we got here — and what the future holds.

Research contributions:

Abhinav Choudhry (Researcher), Theodore Morapedi (Founder & CEO)

1.0_ Systematic Trading: A Brief Historical Synopsis

1.1 _ Early Players in HFT and MFT

Since the very early days of speculation on markets traders have always been quick to seize on any innovation that can lead to generating an alpha, but the golden age of computer science and mathematics in finance really began in the 1980s with the establishment of Renaissance Technologies as well as D.E. Shaw. Both firms founded by professors went on to pioneer a practice of using mathematically and statistically gifted experts, usually from non-financial backgrounds, to conjure algorithms that beat the market.

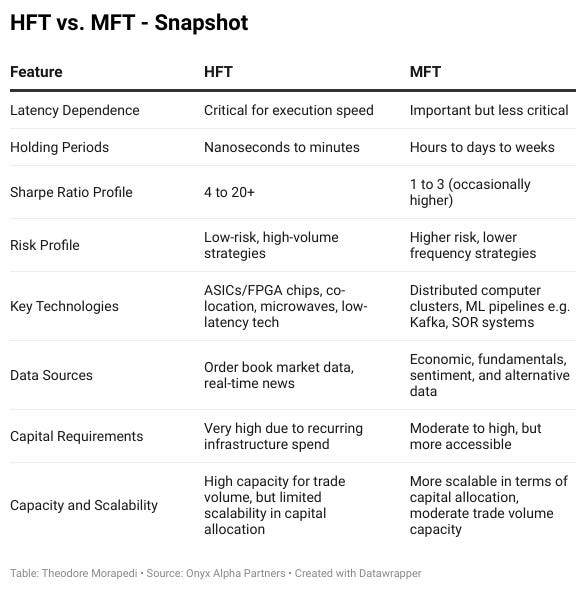

A form of high-frequency trading (HFT) emerged, involving market-making, index arbitrage, statistical arbitrage, triangular arbitrage, and latency arbitrage. It analysed market microstructures, particularly the order book, to compute relatively risk-free strategies. Around the dot-com boom, a more technology intensive approach emerged in HFT. Firms such as Jump Trading led the charge by employing proprietary technology, including custom-built ASICs hardware1, co-location, and advanced transmission technologies, all aimed at achieving the fastest execution speeds2.

Mid-frequency trading (MFT) has technically been around much longer than HFT, in the sense that holding positions for minutes or hours has existed since the dawn of markets. However, specialized algorithms and distributed computing systems changed MFT forever. Firms such as Optiver, Renaissance Technologies, D.E. Shaw, and Two Sigma Investments have employed a mixture of technical analysis on economic, fundamental security and industry level, higher frequency tick data, and alternative data points to achieve an edge3.

(*) Did You Know?

The first recorded “algorithmic trade” was executed in 1976 on the New York Stock Exchange, using a simple program to route orders. It paved the way for the sophisticated algorithms that power HFT today.4

1.2 _ State of the HFT & MFT Markets (Strengths and Challenges)

Around 2009, HFT had become such an important part of the markets that it accounted for 77% of trading volume in the UK markets5. This changed markets significantly, resulting in bid ask spreads collapsing from 0.17% to 0.025%6. Except for increased short-term volatility, financial markets have benefited from increased liquidity and improved price discovery7. Nonetheless, the 2010 flash crash raised concerns about the impact of HFT on market stability: that event was one of the fastest declines ever across all US stock markets with indices dropping 5-15% in minutes and some securities falling as much as 60%8. HFT activity was widely scrutinized in the aftermath, with some market observers suggesting it may have contributed to cascading sell-offs. Since then, regulations, such as the Markets in Financial Instruments Directive II (MiFID II), have become much stricter and resulted in a substantial impact on market structure.

MFT has remained a critical part of the markets and while it lost some of its market share to HFTs in the early 2000s, as markets have become more liquid and data rich MFT has continued to attract allocations from hedge funds as well as smaller investors. MFT strategies inherently involve greater risk and require more sophisticated capital and risk management, but also offer the potential for higher payoffs if capital if scaled well. Unlike HFT, MFT is less dependent on latency optimization, though its algorithms must still undergo continuous refinement. Regulatory constraints on HFT have made MFT increasingly attractive in recent years, particularly as it does not require the same level of technological investment.

(*) Did You Know?

In 1988, Renaissance Technologies’ Medallion Fund began as a mid-frequency quant strategy before evolving into the high-frequency, ultra-profitable fund that has generated over $100 billion in trading profits.9

1.3 _ Arms Race: Searching for Efficiency and Lowering Costs Through Speed

For HFTs, every microsecond matters—the time it takes to receive market data, process it, send trade instructions to the exchange, and confirm execution. Even a billionths-of-a-second edge over competitors can yield significant gains. This has fuelled an arms race to optimize algorithms and trading technology.

MFT traders, while less reliant on ultra-low latency, still benefit from reduced execution times, as faster transactions allow them to lock in optimal prices with cheaper transaction costs. However, the marginal returns on latency improvements are lower for MFT than for HFT, meaning investment in latency reduction must be weighed carefully.

(*) Did You Know?

In 2010, an experiment showed that light travels 186 miles in 1 millisecond. For traders relying on fiber optic cables, every extra mile adds 5 microseconds of delay—enough to lose millions of dollars in an HFT race.10

2.0_Convergence: What Does The Future Hold?

2.1_ Drivers of Convergence:

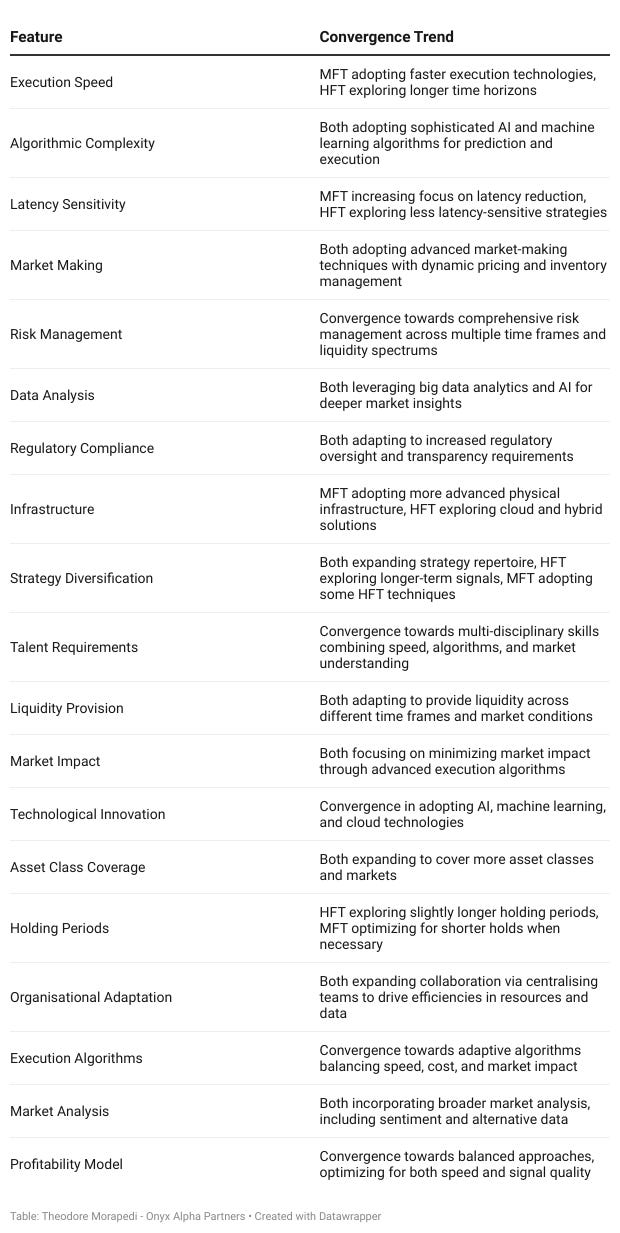

As time passes, we are witnessing the boundaries between HFT and MFT blur. Several key drivers are accelerating this shift:

2.1.1 _ AI and Machine Learning

Artificial intelligence, especially in the form of machine learning is being used by both HFT and MFT firms to enhance signal discovery combining short- and medium-term predictive models11. The key to success is training models on different types and combinations of data to arrive at a predictive model and then backtesting them on historical data. Various machine learning as well as deep learning algorithms are used, but the quality of data remains paramount.

(*) Did You Know?

The earliest automated trading systems date back to 1949, when Richard Donchian introduced rule‑based order execution that operated without human intervention12 . Meanwhile, Herbert A. Simon’s 1958 work on adaptive decision-making and bounded rationality laid important conceptual groundwork for modern machine learning in trading13.

2.1.2 _ Alternative Data

There has also been a data revolution in the form of gradual democratisation of alternative data with the use of real time consumer trends, satellite imagery, credit card transactions, social media trend analysis, and footfall data among others.

Over the past 5 years an increasing number of HFT firms have been actively competing with MFT players. This is evidenced by hiring trends visible on LinkedIn Talent Insights and firm-level postings, showing HFT firms increasingly recruiting from organizations renowned for their alternative data expertise — including HBK Capital Management, Two Sigma, PDT Partners, Bloomberg, and BlackRock. This illustrates a broadening of data reliance among HFT firms, who traditionally prioritized tick-level price data.

2.1.3 _ Centralised and Decentralised Trading

Liquidity fragmentation continues to accelerate, with the growing use of dark pools, lit venues and alternative trading platforms such as private rooms. Cryptocurrency markets, now mainstream, have reached record capitalization in 2024, creating both new opportunities and challenges. Much like the equity markets referenced earlier crypto liquidity is dispersed across multiple-venues which can be categorized into centralized and decentralized exchanges, leading to significant structural inefficiencies. This has made execution more complex, with firms increasingly operating across timeframes to optimize opportunities.

(*) Did You Know?

Centralised exchanges had 6-13 times the trading volume of decentralised exchanges for cryptocurrencies in 202414.

2.2 _ Evolution of Market Microstructure: Bridging the Gap Between HFT and MFT

The structure of financial markets has shifted dramatically over the past two decades, narrowing the previously clear distinctions between high-frequency and mid-frequency trading firms. Regulation, technological advances, and liquidity fragmentation have redefined how firms compete, forcing both HFT and MFT strategies to both adapt and converge.

2.3_Regulation & The Latency Arbitrage Decline

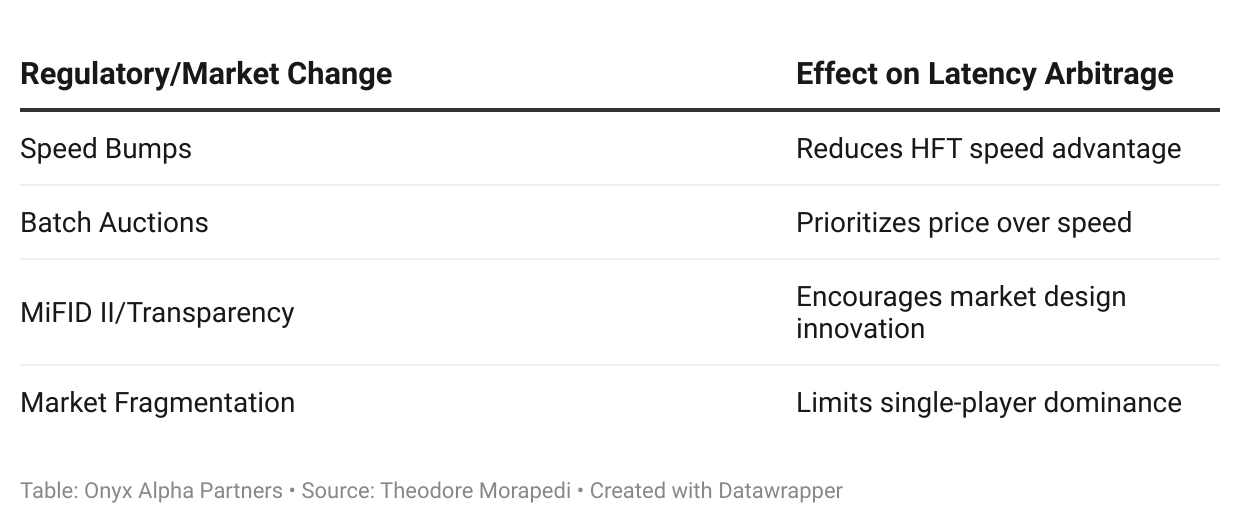

The introduction of Reg NMS (2005) in the U.S. and speed parity initiatives such as MiFID II (2018) in Europe fundamentally altered market dynamics. These regulations increased market fragmentation and introduced stricter execution transparency requirements, directly impacting execution strategies for HFT firms.

The main changes can be summarised as:

This levels the playing field and pushes HFT firms to explore longer time horizons for alpha. The decline of this “arms race” in speed is forcing both strategies to compete more directly for signals. The race will once again be between algorithms in the realm of MFT rather than in getting the best Field-Programmable Gate Arrays (FPGAs).

Previously, speed alone was an overwhelming advantage, but latency arbitrage has been steadily eroded by regulatory changes and widespread adoption of co-location services.

(*) Did You Know?

In 2010, Spread Networks spent $300 million to build a straight-line fiber-optic cable between Chicago and New York, reducing communication time to 13 milliseconds and revolutionizing latency arbitrage.15

2.4_Proliferating Trading Venues and Advancing Execution Technology

Liquidity is no longer concentrated on centralized exchanges. The rise of dark pools, alternative trading systems (ATS) such as private rooms16, and internalized liquidity venues (known as Systematic Internalisers) has introduced significant complexity. These opaque trading environments have made order execution less predictable, forcing HFT and MFT firms to develop adaptive execution models rather than rely on simplistic market-taking strategies.

After MiFID II17 regulations were implemented, HFT firms who once dominant in traditional lit markets have had to rethink execution, borrowing from MFT playbooks by integrating more sophisticated order routing (SOR) and adaptive liquidity prediction techniques. Conversely, MFT firms are now incorporating execution tactics from HFT firms, involving optimizing trade placement across fragmented venues to minimize slippage and market impact.

(*) Did You Know?

The average trade size in dark pools is less than 150 shares18 reflecting the trend of institutions increasingly splitting large orders into smaller transactions to mitigate market impact.

2.5_Blurring the Lines: Who is the Liquidity Provider?

With execution dynamics changing, the distinction between liquidity providers (market makers) and liquidity takers (alpha-seeking traders) has become increasingly fluid.

HFT firms are moving beyond simple market-making into more signal-driven execution, while MFT firms are enhancing their trade optimization to capture microstructure inefficiencies—the very edge that once defined HFT.

The old paradigm where HFT dominated liquidity provision and MFT focused purely on signal generation is rapidly dissolving. Today firms compete across execution speed, predictive modeling, and liquidity access, irregardless of their core strategy.

(*) Did You Know?

The financial industry faced an estimated implementation cost of €2.5 billion for MiFID II.19

3.0_ The Talent Shift: Moving from High-Frequency Trading to Mid-Frequency Trading

As the boundaries between HFT and MFT continue to blur, the demand for quants who can transition between these paradigms is rising. While both rely on statistical models and algorithmic execution, the shift from MFT to HFT requires candidates to refine their approach to forecasting and execution.

3.1_ Signal Horizon & Feature Selection Shift

MFT strategies are often built on multi-minute or hourly timeframes, relying on multi-factor, cross-asset correlations, and market structure inefficiencies. In contrast, HFT signals are extracted from market microstructure patterns, order book imbalances, and ultra-short-term price dislocations.

Candidates looking to weather this transition must develop expertise in high-resolution tick data analysis and be able to engineer features that extract signals from millisecond price movements.

The emphasis shifts from broader predictive models to hyper-granular market event anticipation—understanding how liquidity fragmentation, order flow, and execution queues impact PnL in real time.

3.2_ Execution & Market Impact Awareness

For an MFT quant, execution is often a secondary consideration, but in HFT, it is a direct source of edge. Execution precision determines whether a model generates sustainable alpha or is arbitraged away.

Passive vs. aggressive order placement becomes a defining skill, so knowing when to capture spread vs. cross the spread is a core competency.

Candidates must develop an intuitive understanding of fill probability, order book positioning, and queue dynamics. Put simply, small inefficiencies in execution compound rapidly in HFT.

Many successful transitions involve working closely with execution researchers and infrastructure teams to refine order placement models before diving into full strategy development.

Firms are increasingly looking for quants who can bridge the gap—bringing the predictive rigor of MFT strategies into the execution-driven reality of HFT. Those who can adapt their approach to signal development and execution sensitivity will have an edge in making the transition.

4.0 _ The Future Landscape:

4.1 _ Hybrid Strategies

It’s hardly surprising to see firms adopting ultra-low latency signal processing for MFT models, as MFT too benefits from decreases in latency: it is just that its strategy is not based primarily on latency. HFT execution is likely to get combined with predictive MFT alpha signals that go far beyond the more limited parameters in use now. This is a natural evolutionary response in a competitive landscape.

Let’s observe some real world examples where this is already taking place. A brief examination of IMC’s publicly available information such as their advertised job descriptions offers useful insights. Quant Researcher20 job openings highlight priorities for systematic “alpha” generation where applying ML to high to mid frequency signals, in combination with feature engineers and traders take precedent. When we consider IMC’s undeniable presence in hardware driven low latency trading, these references offer a glimpse into the changing landscape.

Well known names in the HFT community such as Citadel Securities have publicly disclosed their strategic shift toward a diversified trading business.

Their voyage into bond trading, government securities, credit, and FX—areas with thinner liquidity, dispersed trading venues that include over-the-counter (OTC) and less hyper-fragmented speed of trading implies a broader approach than the purely ultra-low-latency equity, futures or options business. LinkedIn Insights illuminates a slate of senior hires from top investment banks and multi-strategy funds, further supporting the trend of convergence of once highly distinct corners of financial markets21.

4.2 _ Demand for a New Breed of Multi-Paradigm Talent

The demand for talent that can operate across both HFT and MFT paradigms has is gaining increasing demand. As the barriers between these strategies blur, firms are aggressively hiring quantitative traders with cross-disciplinary expertise in market microstructure, alternative data, and AI-driven alpha generation.

HFT and MFT rely on high-performance computing - HFT for microsecond execution, MFT for large-scale backtesting and training ML models on big data. The modern quant environment demands quants who can toggle between optimizing code for latency and analyzing enormous datasets for alpha. This suggests that PhDs in hard sciences such as physics might continue to enjoy a premium.

As these trends persist, the proliferation of standardized research frameworks such as shared ML compute clusters and GPU-accelerated HPC architectures is streamlining the infrastructure underpinning quantitative research. This convergence is lowering technical barriers, enabling quants to fluidly transition between HFT and MFT initiatives. The result is a more collaborative, cross-disciplinary environment, where top talent can more readily apply their expertise across diverse trading strategies and research domains.

It will be the duty of the employers to ensure talent are being supported through this transformation, where top employers will employ rotation programs that let new hires experience both short-term low latency trading and medium-frequency alpha research, ensuring that skill sets mature in both arenas.

4.3_ A Shift in Hiring Priorities

Firms that historically specialized in ultra-low-latency execution are now expanding their hiring focus to include predictive alpha generation, while traditional MFT players are recruiting execution specialists to improve trade placement efficiency.

Existing siloes as they exist today will collapse and resources from HFT and MFT teams will be available to use for all employees to benefit from. Shared access to advanced resources allow employees to benefit from economies of scale and an interoperable model will serve as the framework to leverage the best ideas. In this environment, exceptional value may accrue to to the “quantitative trading generalists” those with deep technical expertise in areas like GPU acceleration and FPGA processing, coupled with the ability to backtest and analyze massive datasets to achieve world beating forecasting accuracy.

Top-tier quant talent will no longer be defined by binary categories of HFT or MFT—but by their ability to operate across time horizons, asset classes, and execution styles in this next evolution of the industry.

4.4 _ Challenges

Convergence also creates its own set of new challenges. As strategies become more similar, the resulting crowding effect may exacerbate market swings and systemic vulnerabilities during times of stress, leading to reduced profitability. The shift in strategy will also make the roles of firms less clear and there is likely to be regulatory scrutiny on who are deemed as liquidity providers and liquidity takers. Nonetheless, it is more likely that firms that do not adapt to the trend of convergence will face greater challenges in the future. The business as usual of the hedge fund world is changing and it is time to take note.

5.0_ Final Takeaway

Do you remember when connecting to the internet meant enduring the screeching dial-up tone? You’d sit there, watching the page load line by line, thinking it would never end.

Then, almost overnight, everything changed. High-speed broadband arrived, and dial-up became obsolete and a proliferation of technology advancements ensued.

We’re transitioning through that same supersonic technology shift and the race for performance is transforming quant trading in real-time. Once, HFT dominated through nanosecond execution, while MFT relied on superior predictive signals. Today, the two are converging ‒ driven by AI, alternative data, and a relentless push for efficiency.

The firms that recognize this shift and actively reshape their talent pipelines will win. Those that hesitate will find themselves outpaced by competitors who move faster, trade smarter, and hire better.

At Onyx Alpha Partners, we work closely with our clients to navigate industry transformation by strengthening their edge through precise talent alignment and the thoughtful construction of high-impact quant trading teams.

Contact us to learn more about how we can partner with your business today:

Instantly Book a 30 min consultation using the link below:

https://calendly.com/tmorapedi/one-on-one-chat-with-theo

SOCIAL MEDIA & CONTACT INFORMATION

Email: info@onyxalpha.io

WhatsApp Business: +44 7537 141 166

UK Business Line: +44 7537 188 885

References:

Golub, A. (2011). Overview of High Frequency Trading. Pennsylvania State University. https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=67bfc82e2819a89e126351dc36380000eec8383f

1. Worstall, T. (2014). HFT Really Does Reduce the Bid Ask Spread; Making Michael Lewis Wrong About HFT. Forbes. https://www.forbes.com/sites/timworstall/2014/04/01/hft-really-does-reduce-the-bid-ask-spread-making-michael-lewis-wrong-about-hft/

Lin, P.-H., Rakity, I., Stan, C. G., & Vijayakumar, S. (2024). Assessing the Impact of High-Frequency Trading on Market Efficiency and Stability. Oxjournal.org. https://www.oxjournal.org/assessing-the-impact-of-high-frequency-trading-on-market-efficiency-and-stability/v

Akansu, A. N. (2017). The flash crash: a review. Journal of Capital Markets Studies, 1(1), 89–100. https://doi.org/10.1108/jcms-10-2017-001

Nahar, J., Nishat, N., Shoaib, A. S. M., & Hossain, Q. (2024). Market Efficiency and stability in the era of high frequency trading: a comprehensive review. International Journal of Business and Economics, 1(3), 1–13. https://doi.org/10.62304/ijbm.v1i3.166

1. The Block. (2025).DEX to CEX Spot Trade Volume (%). https://www.theblock.co/data/decentralized-finance/dex-non-custodial/dex-to-cex-spot-trade-volume

Haas, F. (2007). The Markets in Financial Instruments Directive: Banking on Market and Supervisory Efficiency. International Monetary Foundation. https://www.imf.org/external/pubs/ft/wp/2007/wp07250.pdf

1. Picardo, E. (2022). An Introduction to Dark Pools. Investopedia. https://www.investopedia.com/articles/markets/050614/introduction-dark-pools.asp

Greifeld, K., Parmar, H., & Doherty, K. (2023, June 14). Citadel Securities expands into credit markets as Griffin seeks bigger role. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2023-06-14/citadel-securities-expands-into-credit-markets-as-griffin-seeks-bigger-role

Disclaimer:

This article is provided for informational purposes only and does not constitute financial, investment, legal, or other professional advice. The content reflects publicly available information and the views of the authors at the time of writing. No representation or warranty is made as to its accuracy or completeness, and it should not be soley relied upon for any investment or business decision. Readers should seek independent advice appropriate to their jurisdiction and circumstances.